Expert Tips on How to Purchase Reverse Mortgage for Better Financial Stability

Expert Tips on How to Purchase Reverse Mortgage for Better Financial Stability

Blog Article

Step-By-Step: Just How to Acquisition a Reverse Home Mortgage With Self-confidence

Browsing the complexities of purchasing a reverse mortgage can be challenging, yet a systematic approach can encourage you to make enlightened decisions. It begins with analyzing your eligibility and understanding the subtleties of different finance choices available in the marketplace. Involving with credible lending institutions and contrasting their offerings is essential for securing beneficial terms. However, the procedure does not end there; mindful focus to documents and compliance is essential. As we check out each action, it ends up being obvious that confidence in this monetary decision hinges on comprehensive prep work and notified selections. What follows in this necessary journey?

Understanding Reverse Home Loans

The main device of a reverse home mortgage includes borrowing against the home's worth, with the lending amount increasing gradually as rate of interest accumulates. Unlike conventional mortgages, borrowers are not called for to make regular monthly payments; rather, the financing is settled when the house owner offers the home, vacates, or dies.

There are 2 major kinds of reverse home loans: Home Equity Conversion Home Loans (HECM), which are federally guaranteed, and exclusive reverse mortgages supplied by private lenders. HECMs usually supply higher protection as a result of their regulatory oversight.

While reverse home loans can supply financial alleviation, they also include prices, including source costs and insurance policy costs. It is crucial for prospective consumers to fully understand the terms and implications prior to proceeding with this financial choice.

Analyzing Your Eligibility

Eligibility for a reverse home loan is mostly identified by a number of vital factors that potential customers need to take into consideration. Candidates must be at least 62 years of age, as this age requirement is established to ensure that debtors are approaching or in retirement. In addition, the home must serve as the customer's key home, which means it can not be a getaway or rental home.

Another essential facet is the equity position in the home. Lenders usually call for that the debtor has an adequate amount of equity, which can impact the amount available for the reverse home mortgage. Typically, the extra equity you have, the larger the funding quantity you might get.

In addition, possible debtors should demonstrate their capacity to satisfy financial commitments, consisting of property tax obligations, house owners insurance coverage, and maintenance prices - purchase reverse mortgage. This evaluation typically includes an economic evaluation conducted by the lending institution, which assesses income, credit rating history, and existing financial debts

Finally, the residential or commercial property itself have to satisfy details requirements, including being single-family homes, FHA-approved condos, or specific manufactured homes. Understanding these aspects is important for determining qualification and preparing for the reverse home loan process.

Looking Into Lenders

After identifying your eligibility for a reverse mortgage, the following look these up action includes researching lenders that provide these economic items. It is important to recognize trusted lending institutions with experience in reverse home mortgages, as this will ensure you obtain reliable guidance throughout the process.

Begin by evaluating loan provider qualifications and certifications. Search for loan providers that are members of the National Reverse Mortgage Lenders Association (NRMLA) and are accepted by the Federal Housing Administration (FHA) These affiliations can indicate a commitment to moral methods and conformity with industry requirements.

Reviewing client reviews and reviews can give understanding right into the lending institution's online reputation and consumer service quality. Websites like the Better Organization Bureau (BBB) can likewise provide ratings and complaint histories that may assist inform your decision.

Additionally, consult with monetary advisors or real estate counselors who specialize in reverse home mortgages. Their competence can help you navigate the choices available and suggest trustworthy lending institutions based upon your one-of-a-kind monetary circumstance.

Contrasting Finance Choices

Contrasting funding options is an essential step in safeguarding a reverse home loan that straightens with your financial objectives. When assessing different reverse home mortgage products, it is important to think about the details features, expenses, and terms connected with each option. Begin by evaluating the kind of reverse home mortgage that best fits your demands, such as Home Equity Conversion Home Mortgages (HECM) or proprietary finances, which may have different qualification criteria and benefits.

Following, pay attention to the rate of interest and costs related to each funding. Fixed-rate lendings supply security, while adjustable-rate options might supply lower preliminary prices yet can vary with time. Additionally, think about the in advance prices, including mortgage insurance policy costs, origination charges, and closing prices, as these can substantially impact the general expenditure of the car loan.

Moreover, assess the repayment terms and just how they straighten go to this website with your lasting economic strategy. When the financing have to be settled is essential, recognizing the ramifications of exactly how and. By thoroughly comparing these variables, you can make an educated choice, ensuring your choice supports your economic health and wellbeing and supplies the safety and security you seek in your retired life years.

Wrapping Up the Acquisition

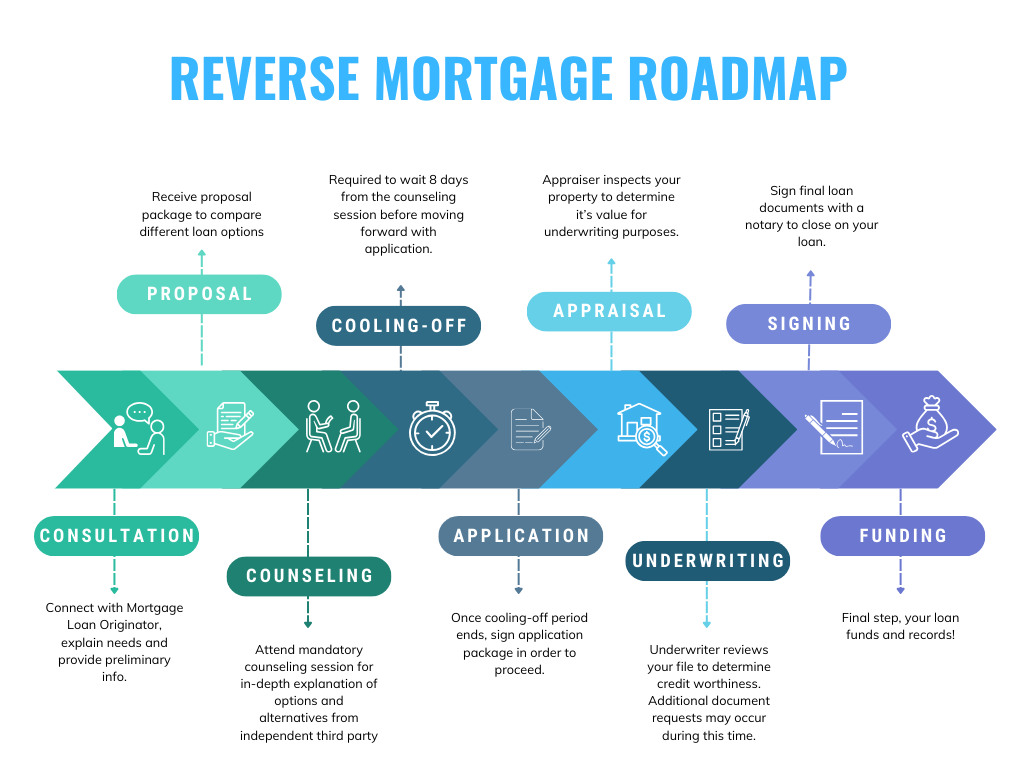

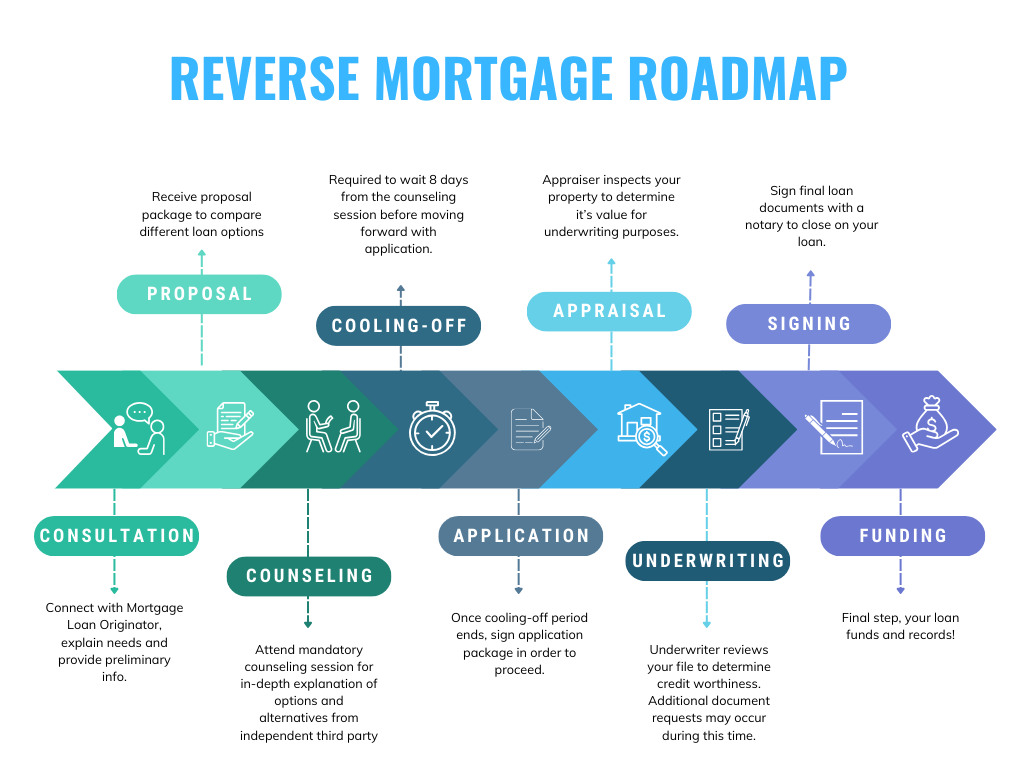

When you have meticulously reviewed your choices and selected one of the most ideal reverse home loan product, the following action is to complete the acquisition. This procedure involves numerous essential actions, guaranteeing that all necessary documents is precisely completed and sent.

First, you will require to gather all called for documents, consisting of evidence of income, real estate tax statements, and homeowners insurance paperwork. Your loan provider will certainly give a listing of specific records needed to promote the approval procedure. It's essential to give precise and full information to prevent hold-ups.

Next, you will undertake an extensive underwriting procedure. During this phase, the lending institution will examine your economic situation and the worth of your home. This might include a home evaluation to establish the residential property's market value.

When underwriting is total, you will certainly receive a Closing Disclosure, which describes the last regards to the loan, including charges and rates of interest. Review this document very carefully to make certain that it straightens with your expectations.

Conclusion

Finally, browsing the procedure of acquiring a reverse mortgage requires an extensive understanding of eligibility requirements, attentive study on lenders, and careful comparison of finance alternatives. By methodically adhering to these actions, people can make enlightened choices, making certain that the picked home mortgage straightens with economic objectives and my explanation demands. Inevitably, an educated technique promotes self-confidence in safeguarding a reverse home loan, supplying monetary security and assistance for the future.

Look for loan providers that are members of the National Reverse Mortgage Lenders Association (NRMLA) and are approved by the Federal Housing Management (FHA)Contrasting loan choices is an essential action in protecting a reverse mortgage that aligns with your financial goals (purchase reverse mortgage). Start by evaluating the type of reverse home mortgage that ideal matches your demands, such as Home Equity Conversion Home Loans (HECM) or proprietary fundings, which might have different eligibility criteria and advantages

In verdict, browsing the process of acquiring a reverse home mortgage needs an extensive understanding of eligibility criteria, attentive research study on loan providers, and careful contrast of finance choices. Ultimately, an educated strategy cultivates confidence in safeguarding a reverse mortgage, giving financial security and support for the future.

Report this page